If you're new to investing, the stock market can seem […]

What Makes a Good Stock?

In the last lesson we explained a little bit about how the stock market works, and gave an example of a good stock that was profitable for investors.

So... what is it that makes a good stock?

It's a good company!

Sounds simple, right? Well... it is. Remember, when you buy shares of stock, you're buying ownership in the company behind the stock. You're saying "I want to be

One of the best ways to determine if the company is a good one is to simply see what you, and others, think about the products and services it sells. Netflix changed the world, and I'd be willing to bet you saw that it was awesome way before the stock did this:

I know what you're thinking... "Really? THAT'S all there is to it?

Your skepticism is good. Of

The company is growing!

In business, if you're not growing, you're dying. Is that true in life as well? Maybe. But it's definitely true in business.

So, how do you know if a company is growing?

Every publicly traded company has to disclose its financial statements quarterly (every three months). These filings are public information

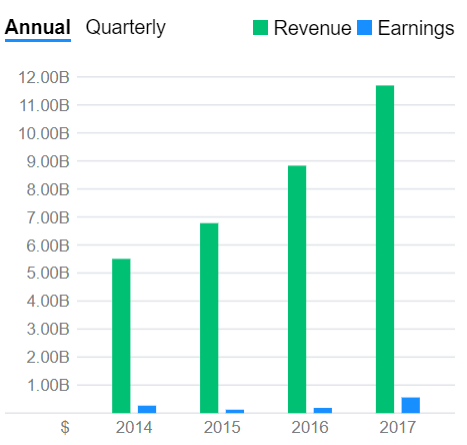

Revenues (sales): If sales are growing consistently year

Earnings (profits): Revenues - expenses = profits. The more profit a company makes, the more likely it is to pay its shareholders (you!) a higher dividend, and the more valuable the overall company will be (and thus your shares.)

Here's what that looks like on a snap chart from Yahoo Finance (one of my favorite places for quick research)

Note that for a high-growth stock like Netflix, the focus of investors is on revenue growth --- they're assuming the company can shift to profitability later once the whole world is on the service. On the other hand, established companies like IBM or John Deere are usually judged more heavily on their earnings (profits).

MYTH BUSTING: You cannot time stocks by buying them prior to the company's "hot" time of year. Many companies are cyclical, meaning they have one or more parts of the year that are more important than other parts of the year. For many retailers, the holiday season is very important. For Weight Watchers, it's all about getting people to sign up for their New Year's resolution. A cyclical business's growth can only be determined by looking at its revenues and earnings on a year over year basis. The company is NOT going to get more valuable if holiday sales are barely higher than the prior three months when holiday sales are expected to be twice as large as the prior month. It's

Other ways of measuring growth is by watching the number of employees (headcount growth usually means things are going well), number of stores opened, and % of market share owned.

Not so fast....

Growth is good, but like we alluded to in the myth busting section above, it's all about expectations. If a company is expected to have 10% more profits this year than last year, but only achieves 5% growth, that could actually disappoint investors and reduce the value of the company.

We'll get more into predicting growth vs. Wall Street (investor) expectations down the road. Luckily, through the use of LikeFolio data, we're pretty darn good at it.

In the next lesson, we'll dive