Cars are getting older... The average age of cars on […]

Can AutoZone Keep its Earnings Win Streak Alive? (AZO)

Can AutoZone Keep its Earnings Win Streak Alive? (AZO)

Replacement car part retailer, AutoZone (AZO), is on a winning streak…Reported Revenue and EPS numbers have surpassed Wall St. expectations in the past 5 quarters.

Can AZO continue to outperform expectations this week?

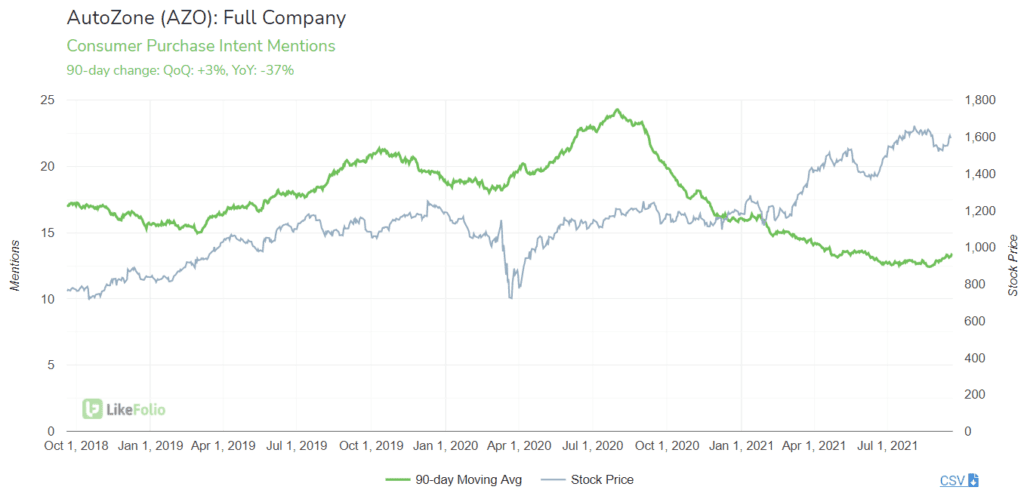

Consumer Demand growth has pulled back significantly in 2021: -37% YoY on a 90-day moving average.

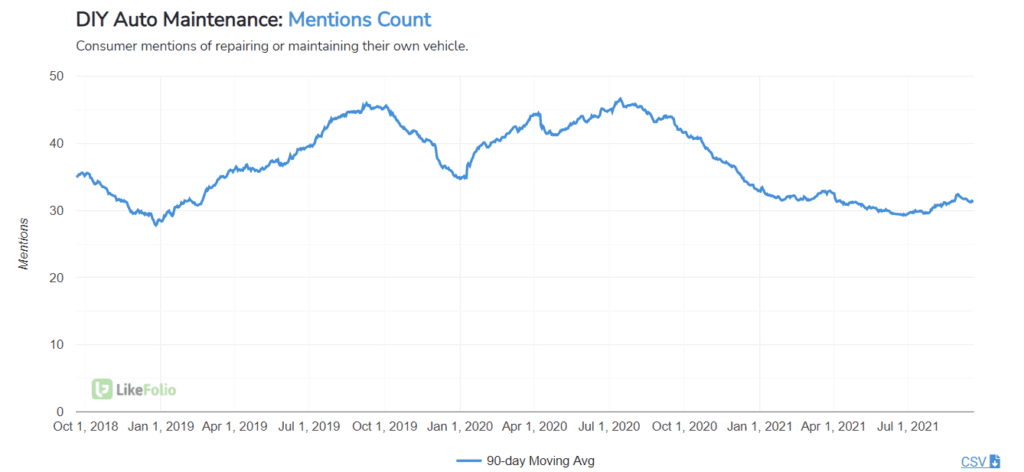

Last Summer, Autozone's Purchase Intent Mentions rose at an all-time high level, corresponding with an all-time high for the DIY Auto Maintenance Trend.

DIY Auto Maintenance Mentions have also declined on a YoY basis, currently trending -27% YoY (90d MA).

Although this doesn't bode well, AZO has seen a strong increase in sales from its commercial “do-it-for-me” (DIFM) business in recent quarters– Revenues from its commercial business rose +44% YoY in 21Q3.

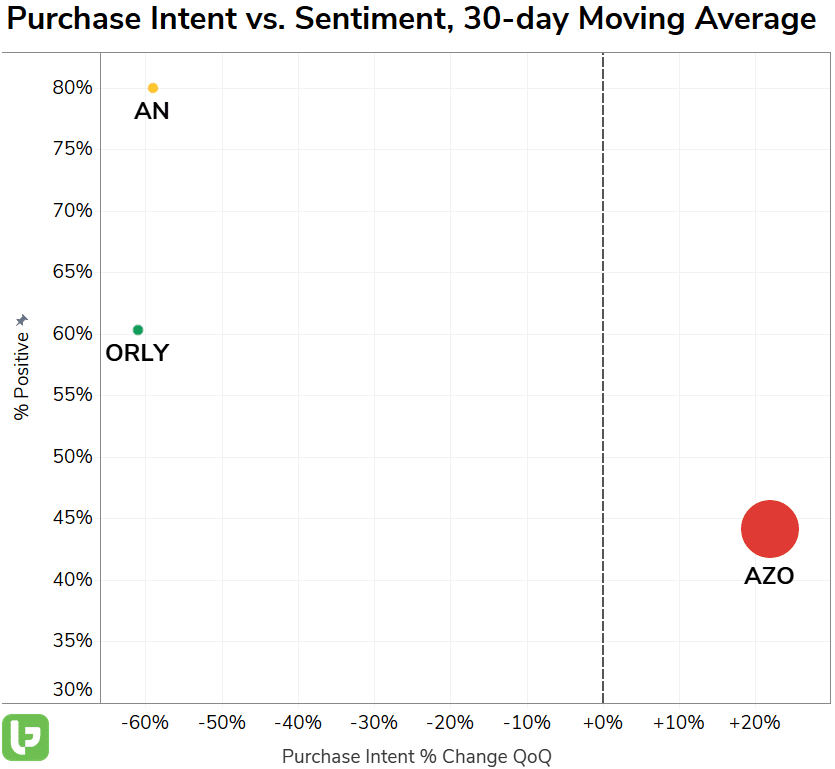

We’re also seeing relative near-term strength for AZO – Purchase Intent Mentions have risen +22% QoQ on a 30-day moving average, outpacing those of its smaller peers.

This scatterplot highlights AutoZone's dominant position in the retail auto part industry, as well as showcasing its relative weakness in terms of Consumer Happiness.

This combination of factors provides a mixed outlook for AZO, whose shares are currently trading near an ATH level (+40% YoY). Market estimates for the coming report (21Q4) are slightly below the all-time highs seen last year, which provides further room for AZO to post a surprise.