Lowe's (LOW) Home Depot is trading ~3% lower today after […]

Will Home Reno Normalization Ding Home Depot $HD?

Will Home Reno Normalization Ding Home Depot $HD?

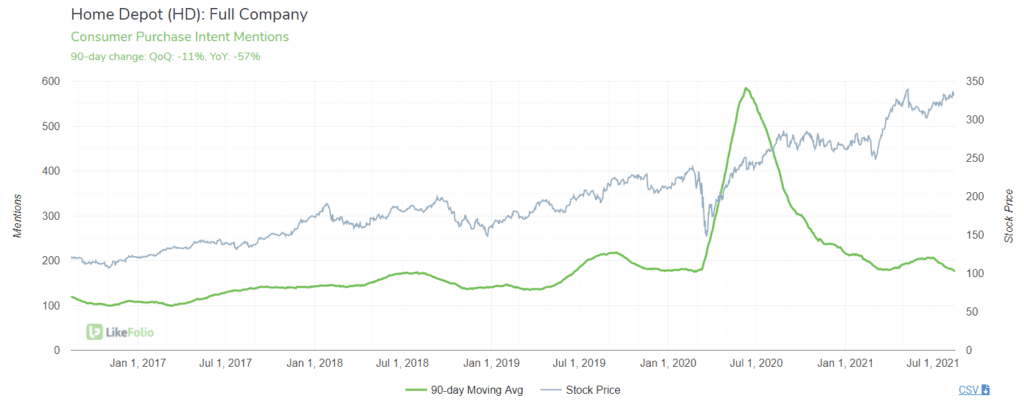

Last quarter, the market posted a muted reaction to a strong HD report. Revenue increased +33% YoY, online sales increased +27% YoY as consumers continued spending more on home projects (fueled partially by a booming housing market). Shares closed down -1%. The CEO noted that new home supply was helping to sustain demand for home improvement projects in the short-term: "The current shortage of new housing clearly is helping to drive improvements in the home values, which is a good thing for spending in the home." According to LikeFolio Data, Home Depot may have a very high bar to clear. Consumer mentions of shopping at Home Depot remain well below Covid-induced highs.

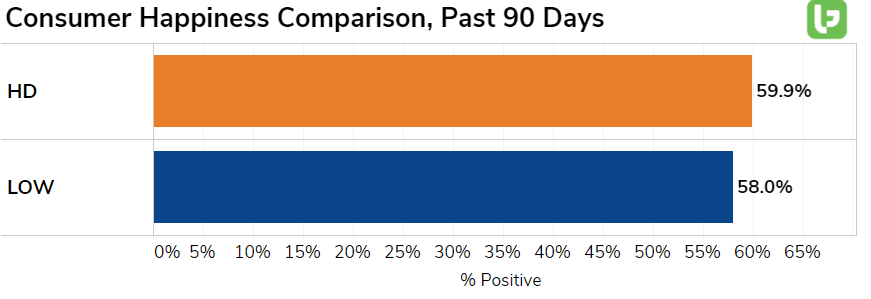

Home Depot continues to slightly outperform peer Lowe's, though both have benefitted tremendously from shifting priority for home improvement in the last year and a half. Both companies show some weakness heading into 21Q2 reports, driven by declining buzz and demand as consumer interest in home renovation normalizes.

- Home Depot Purchase Intent: -57% YoY

- Lowe's Purchase Intent: -60% YoY

- Home Renovation mentions: -32% YoY

Home Depot has recorded improvements in sentiment in the last year: +7 points to 60% positive, driven by a wide product selection, a competent customer service team, and perceived low prices.

This is 2 points higher than LOW, exactly the same as W, but lower than trendy decor specializers Williams-Sonoma (71% positive) and Restoration Hardware (76% positive). Looking ahead, Home Depot is investing in digital, and next-day fulfillment. The company is expanding its distribution centers. A national network of 150 facilities is part of Home Depot’s delivery expansion, which aims to provide next-day services to 90% of the U.S. population. Home Depot has also recorded stickiness in omnichannel purchasing behavior. Digital and curbside pickup mentions remain +19% higher vs. 2019. We like this name long-term, especially because of its successful omnichannel strategy and continued focus on building out logistics. But growth may be stunted on this report, comparatively.