Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Trouble for Lululemon?

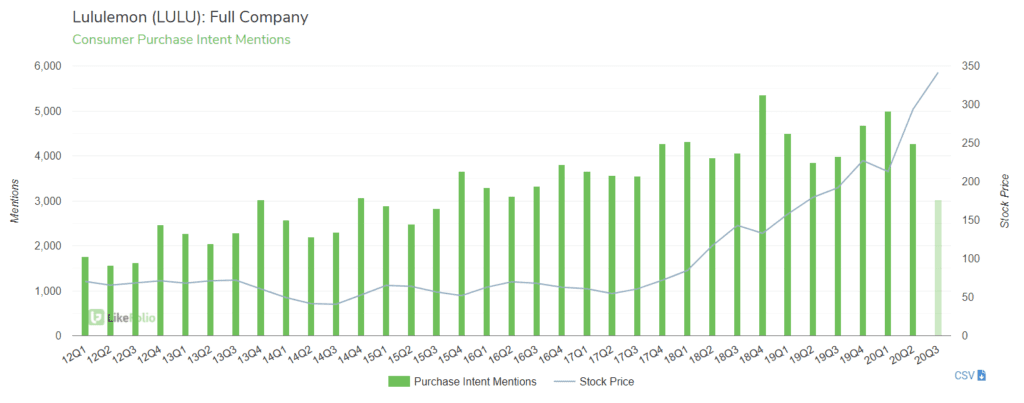

Lululemon (LULU)

We won't lie, we were shocked to see athleisure-darling Lululemon launch a "We Made Too Much" section on its website. It's full of markdowns for more than 480 products.

But then we took a look at LikeFolio data, and it made much more sense.

That shaded 20Q3 bar on the far right ends Nov. 1... and it's currently pacing -29% QoQ and -24% YoY.

-24% YoY is almost exactly in line with what LULU said stores were averaging when it reported in September.

We're watching demand for Lululemon very closely into the Holiday season. With recent corrections in the stock, Purchase Intent softening seems to be priced in pretty fairly.

Chegg (CHGG)

Consumer mentions of utilizing CHGG software and services continues to boom in the current quarter, pacing +88% YoY. We expect...