New Money Still Flooding into Metal Commodities (Silver, Gold, Uranium) […]

Sprott is Squeezing the Uranium Market $URA, $SRUUF

Sprott is Squeezing the Uranium Market $URA, $SRUUF

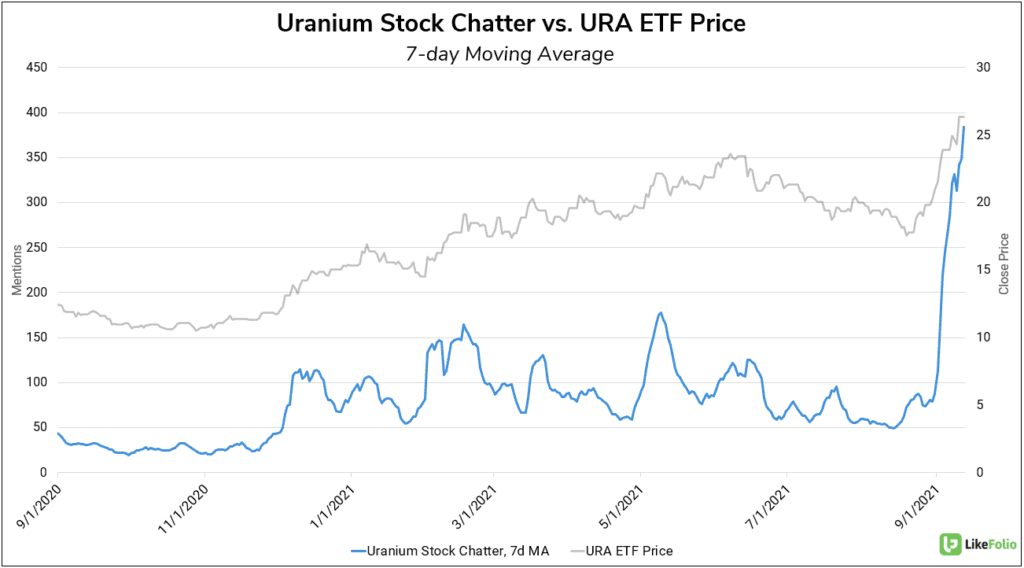

Over the past 2 weeks, the price of Uranium, required for nuclear energy production, has gained by more than +30%. And LikeFolio data shows that investors’ interest in the commodity is at a historic all-time high. Investor chatter relating to uranium, the most popular Uranium ETF ($URA), and now the ongoing “uranium squeeze” has risen to substantial new highs on a 7-day moving average and has yet to see signs of slowing.

An uptick in the price of Uranium, beginning in late 2020, saw chatter begin to build – The recent squeeze has resulted in a parabolic gain, driven by scores of eager new uranium investors. How did this happen? The uranium market is relatively small compared to more popular commodities (copper, silver & gold), with just ~$6.3 in annual consumption. However, a new player in the market has triggered a price squeeze: Sprott Physical Uranium Trust ($SRUUF). The Sprott Trust has been buying up as much uranium as it can obtain, driving up the price of the scarce resource and generating more demand from investors.