Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Salesforce Usage Mentions Suggest Retention

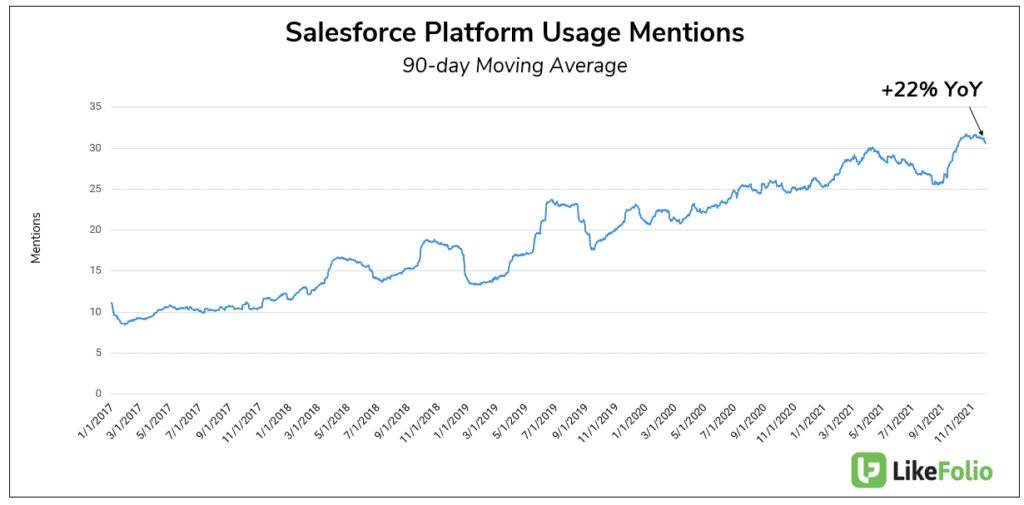

Salesforce earnings have exceeded market expectations on its 2 past reports, sending shares higher post-earnings both times. Year-to-date, CRM shares have gained around +34% in value. Now investors are wondering, can Salesforce maintain its momentum? LikeFolio data suggests, yes it can -- at least from a consumer perspective. Consumer mentions of using a service under Salesforces’ umbrella, including Tableau, MuleSoft, and Slack, are on pace with 2020. Salesforce Platform usage mentions, specifically have increased +22% YoY.

From a volume perspective, the company's legacy Customer Relationship Management platform (Salesforce CRM) dominates mention volume. But it's worth noting that MuleSoft usage mentions are also showing serious strength, increasing +66% YoY. At its core, MuleSoft helps businesses connect multiple streams of data to create a single view of a customer. As companies increasingly seek to leverage data, across the board, it's easy to see why this functionality would be so useful. In addition, CRM consumer happiness levels remain extremely high for a software platform with this level of mention volume: 84% positive. Consumer analysis suggests a learning curve when it comes to the platform...but loyalty once it is mastered.

So, what are we watching ahead of earnings? From a benchmark perspective, CRM has delivered revenue growth of +20% in 5/5 of its last quarters. And usage momentum suggests the company is on track to continue this level of performance. CRM will release 22Q3 earnings Nov. 30 after the bell.