Rivian is an American automaker specializing in electric vehicle production. Today, […]

Rivian (RIVN) Shares are Revving

Rivian is the newest player in the electric vehicle market, and boy did it make an entrance.

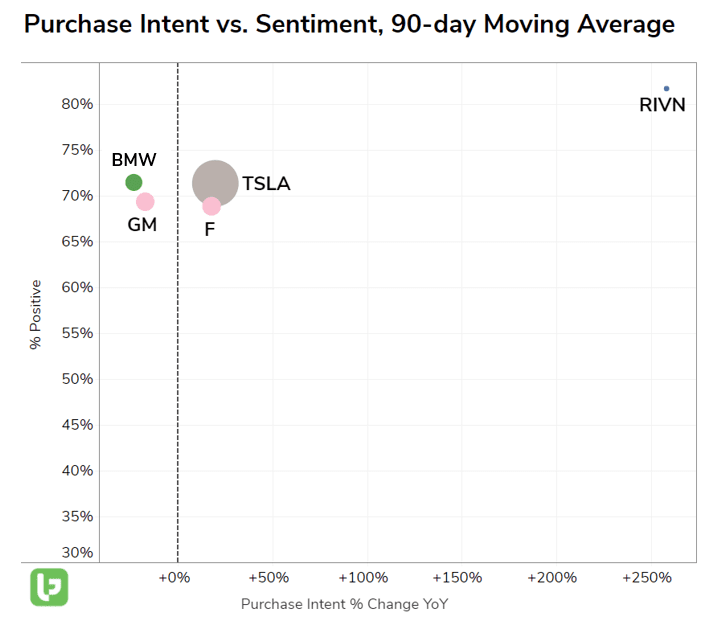

Check out demand and happiness compared to peers in the last 90 days...

The company made its public debut November 10, trading under the symbol RIVN on the Nasdaq. Initial shares were priced at $78 but opened +50% higher, just above $106.

This upward trajectory is continuing today, with shares trading more than 17% higher vs. yesterday's close.

But who is this company, and does data support this extremely high (and growing) valuation?

Let's break it down.

At first glance, Rivian is positioning itself very differently vs. the other top player in the EV game: Tesla.

Tesla is a luxury vehicle first (with cool doors and a unique design) and the brainchild of a captivating CEO, Elon Musk, second. The electric nature of Tesla is certainly a selling point with consumers, but it's not necessarily top of mind.

Rivian, in contrast, is positioning itself to "solve problems undermining the health of our planet and its inhabitants."

Its vehicle line-up is adventure-worthy, featuring a truck and SUV, and its imagery is shrouded in views of trees and mountains and families hiking.

Its company "about us" doesn't even feature a picture of a vehicle.

Talk about a different vibe.

While Rivian has nailed down its brand image, it still has some things to work out when it comes to actual electric vehicle sales.

It doesn't have an official business model yet, and it doesn't expect more than $1 million in revenue in the third quarter.

But it does have a lot of things going for it:

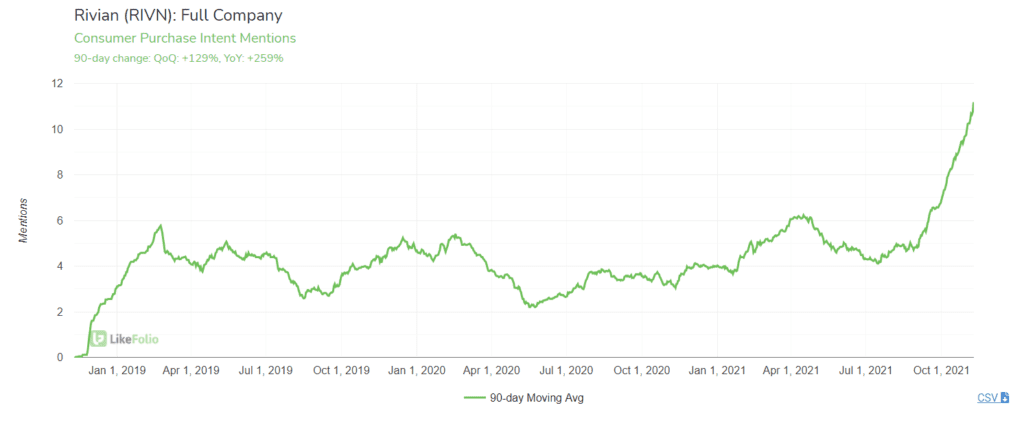

1. Consumers are lining up to buy a Rivian vehicle.

Demand is rocketing alongside its public trading debut. The company noted more than 55,000 R1T (truck) and R1S (SUV) preorders as of Halloween.

And this consumer-facing Purchase Intent doesn't capture the estimated 100,000 electric delivery vans ordered by Amazon and is expected to be on the road by 2030.

Speaking of Amazon

2. Rivian has backing from two major players: Amazon and Ford.

Not only is Amazon planning to release thousands of Rivian electric delivery vans on the road in the next decade, but it also holds a 20% stake in the company.

Ford, which is developing its own line of electric vehicles, holds a 12% minority stake in RIVN that it deems a strategic investment.

3. Consumers are buying into Rivian's brand hype.

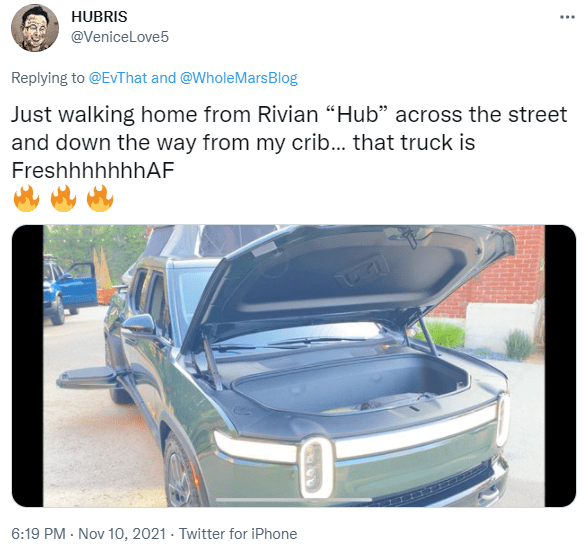

The company was the first to market with a fully electric truck. Sales are direct-to-consumer, and many trucks have already been spotted on the road. The company noted ~50 vehicles, mostly to employees, and expects additional deliveries before the end of this year.

Tweets are overwhelmingly positive related to the Truck's appearance.

4. Rivian is being bolstered by a major consumer macro tailwind: electric vehicle demand

Consumer demand for electric vehicles continues to push to new highs.

And Rivian appears to have carved itself a niche in the adventure market.

The RIVN hype is about more than the share price. And we can't wait to watch how demand unfolds.