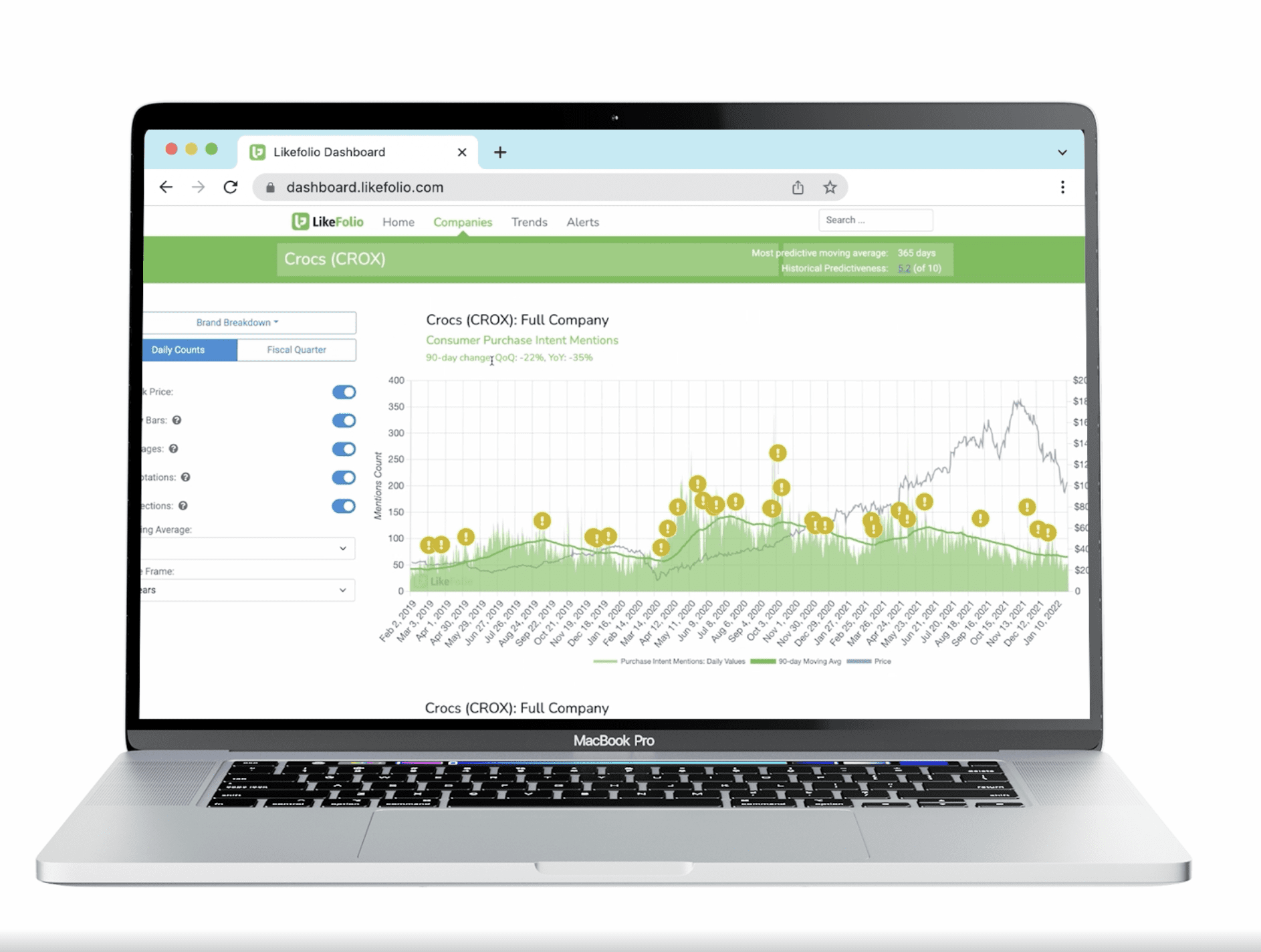

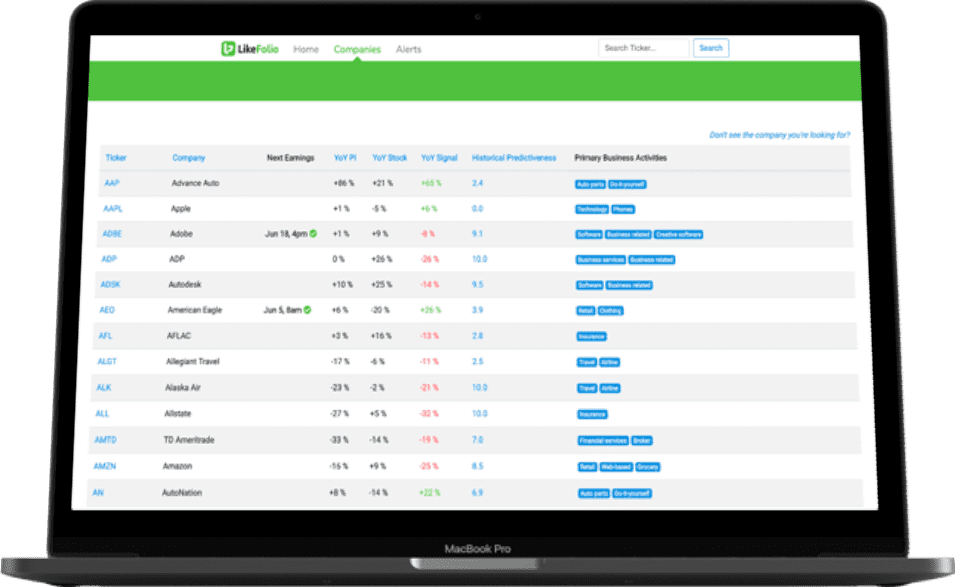

LikeFolio understands that at the end of the day, it’s all about performance. That’s exactly why we are so committed to the success of our fund partners. Here are a few examples of the ways that we have helped other firms create alpha:

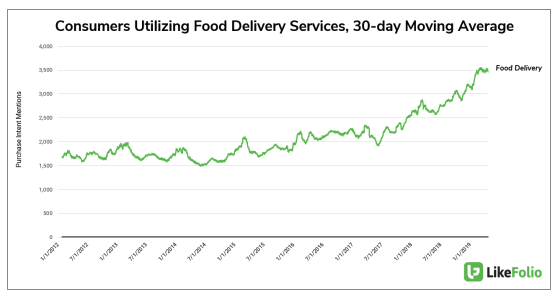

A Report: Deep dive into which food delivery companies are getting the most traction with consumers.

A Research Request: Is the cord-cutting movement stalling out? If not, which device-maker is winning?

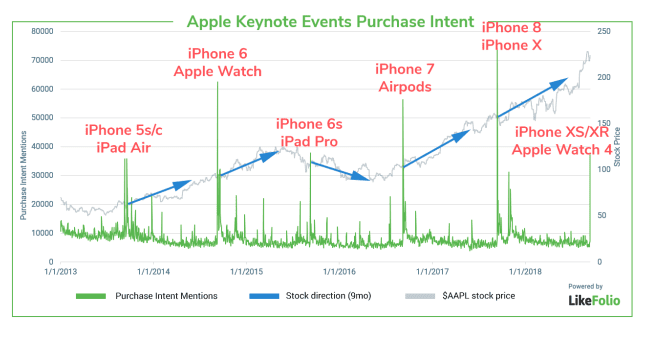

An Alert: Apple iPhone unveil disappoints consumers, expect soft sales.