United Parcel Service (UPS) After two quarters of explosive demand […]

New Money Still Flooding into Metal Commodities (Silver, Gold, Uranium)

New Money Still Flooding into Metal Commodities (Silver, Gold, Uranium)

LikeFolio data shows that individual investing activity has risen substantially over the past 2 years – These new investors have flooded into a variety of assets, including stocks, real estate, cryptocurrency, and even commodities.

Although underlying mentions suggest that the number of new stock traders has hit a plateau, investor interest in select commodities is still on the rise- Primarily precious metals, as well as uranium in recent months.

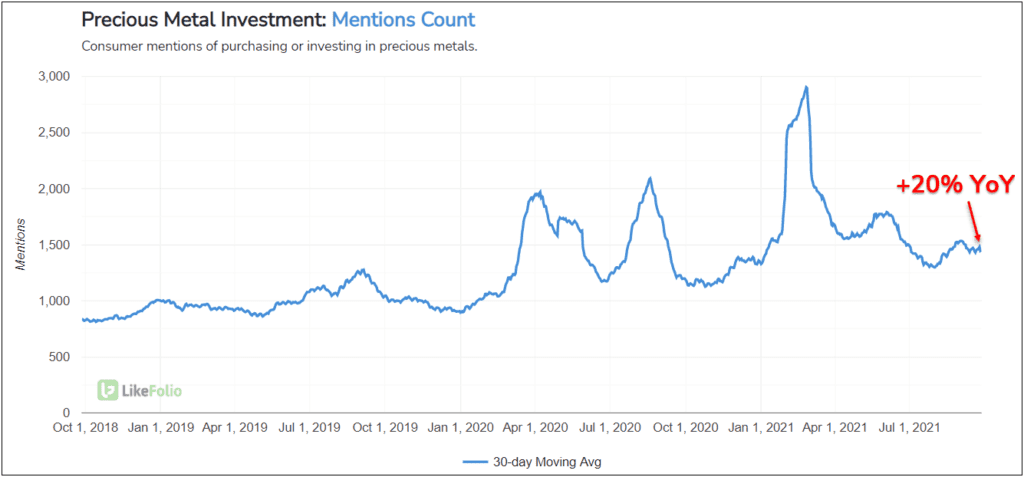

Consumer Mentions of purchasing and investing in precious metals are showing continued strength: +20% YoY on a 30-day moving average.

We’ve seen this trendline rise and fall alongside swings in the price of the underlying assets: Gold (GC=F), Silver (SI=F), and Platinum (PL=F). Still, combined investor interest in these assets is maintaining a higher level overall.

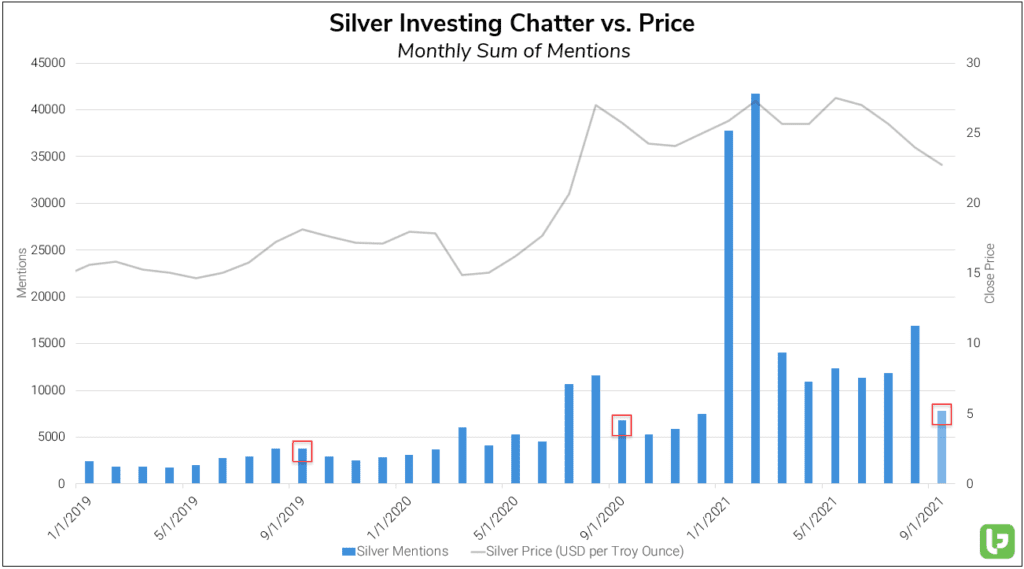

Heightened investor awareness can be seen on an individual level as well -- Mentions of silver miners, stocks and the most popular silver ETFs are on pace for a +10% YoY gain in the current month, trending more than +100% higher than the levels seen in 2019.

At present, the majority of individual investors are unable to meaningfully participate in these markets (trading contracts on the COMEX exchange), so their influence over the price in the short term is suspect.

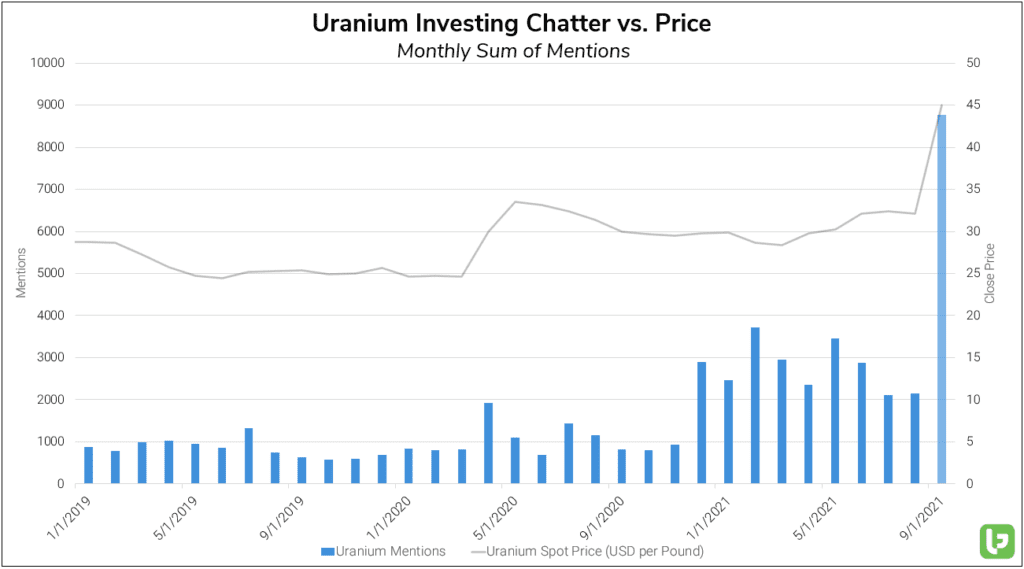

However, the growing popularity of physical ETF products like the Sprott Physical Silver Trust ($PSLV) and the Sprott Physical Uranium Trust ($SRUUF) could disrupt the status quo. Buying constantly issuing new shares and accumulating more of the underlying asset, these physical ETFs promise to provide smaller investors with a means to impact the supply and demand structure of the underlying futures market.

We’ve already seen this principle in action, with the debut of the Sprott Physical Uranium Trust leading to a massive spike in the futures price of Uranium (UX=F) – This event also brought a fresh wave of investor attention to the uranium market.

Investor Chatter surrounding the Uranium and its most popular ETFs had already shown strength through the beginning of 2021…It’s since ballooned to an ATH level in the current month, trending +960% YoY and nearly +1300% vs. 2019.