Tiffany's (TIF) will report quarterly earnings Wednesday prior to the […]

Is Lululemon Still a Growth Story? $LULU

Is Lululemon Still a Growth Story? $LULU

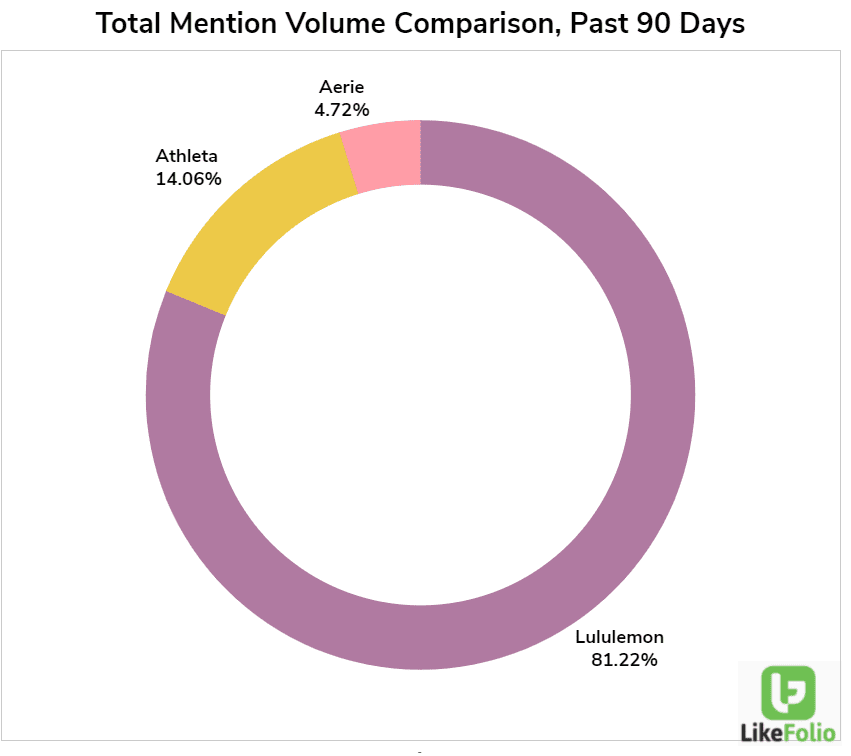

| Lululemon is the dominant player in high-quality Athleisure. When we examine total mention volume for major players in the pure "athleisure space" like Gap's Athleta and American Eagle's Aerie brand, Lululemon holds more than 80% of Total Mention volume. |

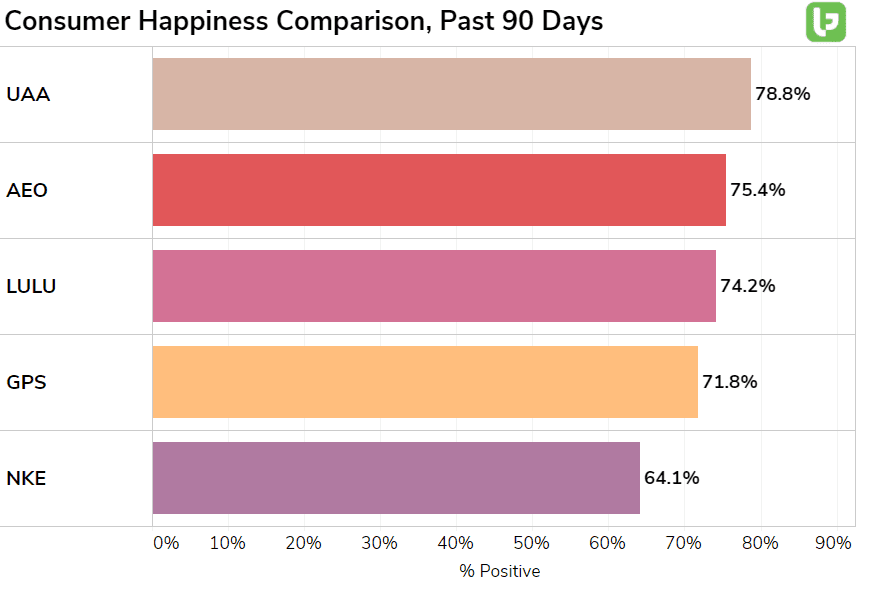

| And consider this: Lululemon's trailing 12-month sales totaled $5.5 billion -- or ~3% of the global sports and fitness clothing market. LULU shares have gained more than +608% in value in the last 5 years. Naturally, the street is wondering: Is Lululemon still a growth story? LikeFolio data provides insights into 4 key factors for continued audience expansion: 1. Consumer Happiness Lululemon's sentiment is consistently above 74% positive, placing it in the upper echelon of performance apparel and 10 points higher vs. Nike. |

| Its high-quality products do give the company a leg up in pricing power.

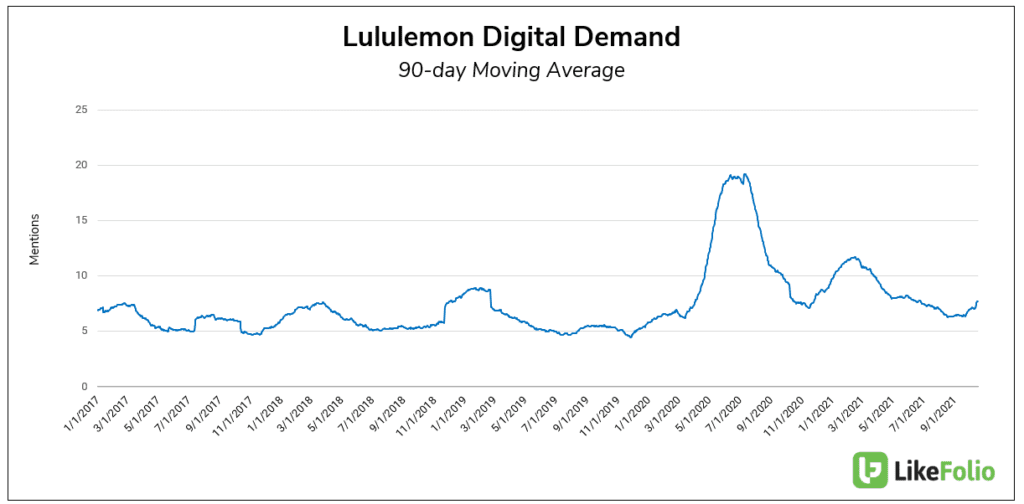

2. Digital Demand In 20Q2, digital sales increased by +157% YoY. In 21Q2, digital sales increased an additional +4% -- Insane traction. LikeFolio data confirms stickiness in eCommerce channels. Mentions remain significantly higher vs. 2019 levels and have increased +7% QoQ. |

3. New Audience Segments: Men

One key segment Lululemon hopes to continue growing is menswear...The company noted a slowdown in men's growth during COVID, when most shopping shifted online.

With the return of in-person shopping, are LULU men's sales returning?

LikeFolio data suggests relative flatness here. Mentions are +4% vs. 2019, but -10% YoY and -7% on a QoQ basis.

4. New Services: Home Fitness

Lululemon's Mirror acquisition in 2020 tapped into a growing workout-from-home trend.

Sales from this segment currently represent less than 5% of Lululemon's total sales...but this could grow. The company has MIRROR shop-in-shops in 150 Lululemon stores, with 200 shops expected in time for the holiday season.

LikeFolio data shows little traction here, with mention volume falling -19% on a QoQ. We will monitor this closely through the end of year.

All in all, LikeFolio data shows that Lululemon's performance is almost exactly in-line with the Street's expectations. If Earnings were this week, the company's score would be exactly neutral: 0.

Keep an eye on this name as Holiday shopping starts to pick up in Q4...