Performance Data: This 1-2-3 Strategy Could BOOST Profits BIG

Stock Chatter Alerts RESULTS

We have completed early analysis on the performance of our new Stock Chatter Alerts product. We're about a month in.

Please note that all of these data points are intended for educational purposes, and are not claims of any client's actual realized profits, nor are they promises of any future returns (duh).

Here are key takeaways that stuck out...

The 1-3 Day Sweet Spot

Obviously, those average gains per trade are really good, but there is something to be learned in this data.

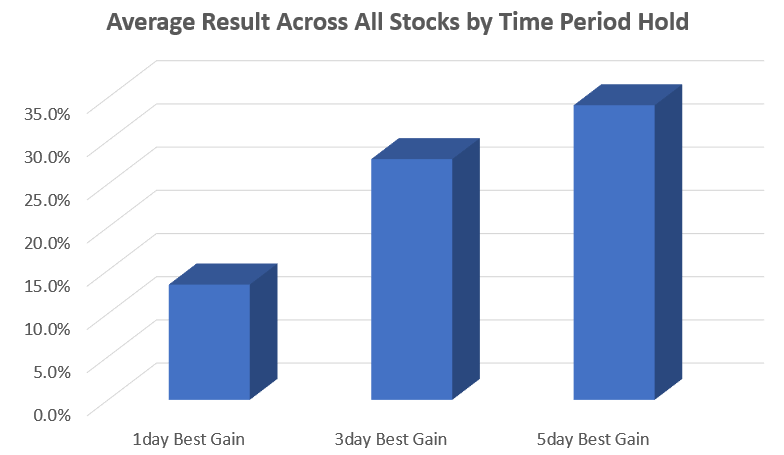

The "best possible profit" on the first day after an alert is issued is averaging an incredible 13.3%, but this more than doubles to an incredible +27.9% if you take it out to a three day period.

Interestingly, moving out to a five day period only adds about 6% of additional profit potential (and of course, more risk.)

Key takeaway: These momentum trades seem to be best suited for a 1-3 day hold period, rather than letting them run.

Winners Win, Losers Lose

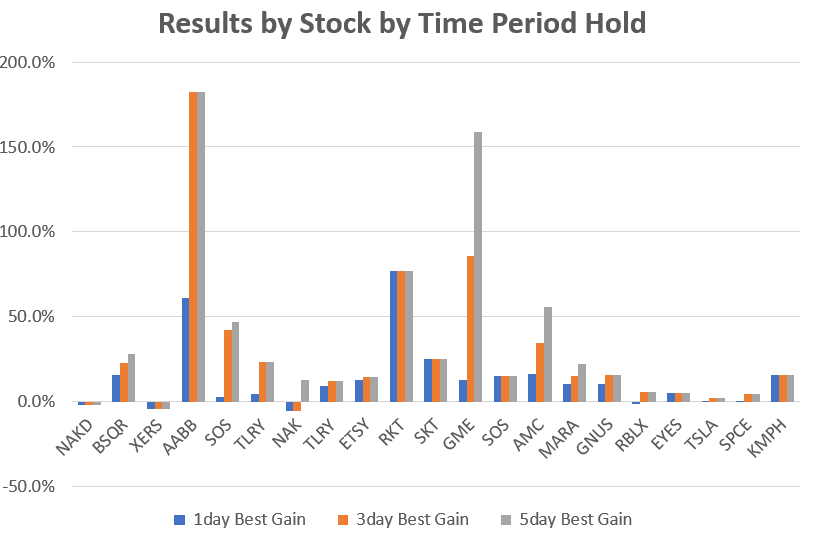

When we zoom in to the individual stock performances by time period, a few key things stick out at me:

- A small portion of the trades are responsible for a bulk of the potential profits. This makes sense, because they are momentum plays -- if the momentum we're seeing (in both price action AND investor chatter) holds strong, the stock can run HUGE.We saw this with 3 day potential gains of 182% on AABB, and 158.7% potential profits on GME.

- Bad starts = bad trades. Stocks that don't do much for us the day following entry tend NOT to come back to profitability.

- Good starts = potential big wins. Stocks that moved our way initially had a good chance of extending their gains for the next 1-2 days. This was especially true if the stock continued to move our direction THROUGHOUT the first day.

Creating a STRATEGY

I knew this was a momentum-based approach from the very beginning, but the performance data has really nailed down some key takeaways for me:

- Move on quickly. Most will be "duds" -- as in small losses or small gains. If nothing happens early in the trade, consider it a bad date and do NOT marry the stock!

- Play for "lotto" wins by letting winners ride. I really think the key here is in the first and last hour of each trading day. If a stock gaps higher and holds that level, it's probably worth giving another day.

- "Fun Money" only! I know (believe me) it's tempting to watch the first month of results, see absolutely incredible returns, and think "I've got to put a lot of money into these trades." But we need to keep the greed in check.

This is an incredibly small sample size, the stocks are naturally quite volatile, and we have not seen a fast, massive loser yet. WE WILL.

If you can't handle a 25%-50% loss in a day, you're trading with too much.

This should be FUN!