Yesterday's accidental roll out of Instagram's horizontal scrolling interface marks […]

How Snapchat's User Base Imploded Since Its IPO

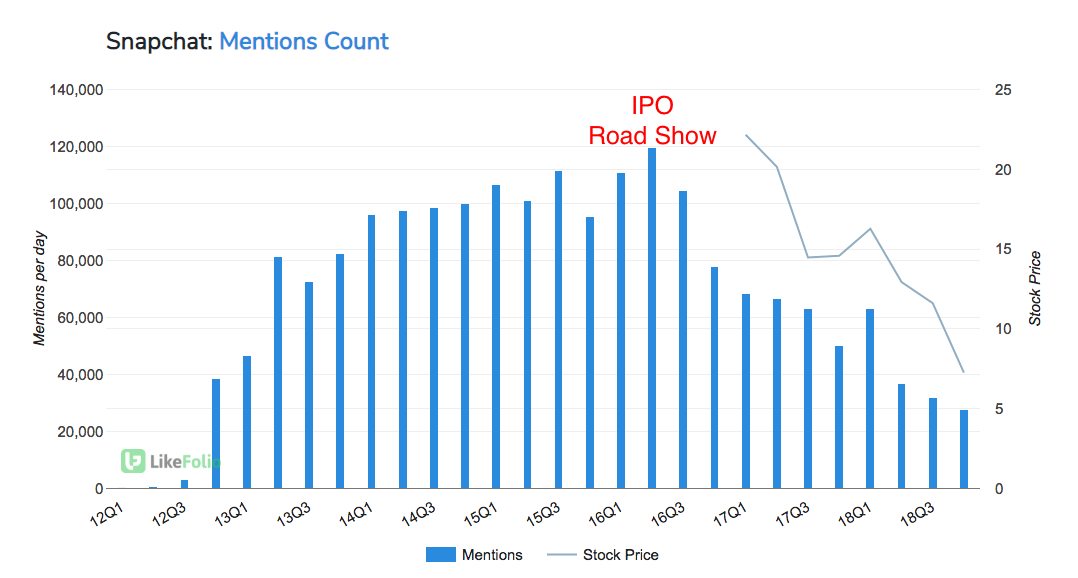

Snapchat's IPO timing was...well... incredible. They literally took the company public at its peak of popularity, as shown here using data from the LikeFolio Research Dashboard:

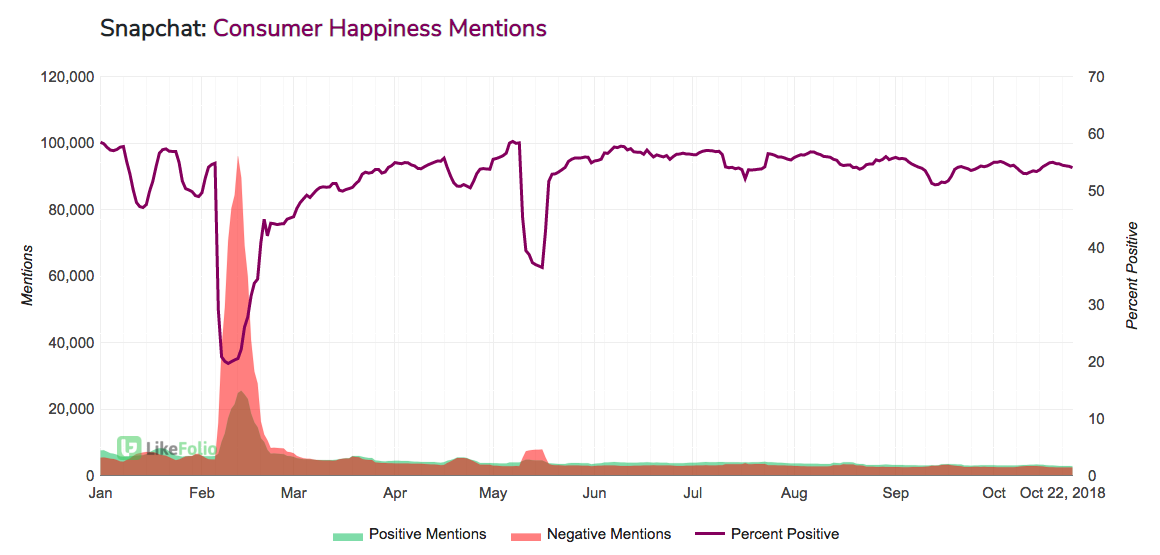

In fact, the only quarter since the IPO where we saw growth in consumer mentions was the first quarter of this year, and it wasn't for positive reasons.

That huge spike in negative mentions came in mid-February as Snapchat rolled out their new user interface, which managed to infuriate its user base. A mass exodus began, with many never coming back to the company (instead sticking with Instagram's similar stories product). In fact, consumer happiness metrics were so bad that with the stock at $19/share we put out a special report on Snapchat's user revolt.

Today, Snapchat stock is down to $6 per share with very little hope for investors in sight, as the company announced yet another major loss in users and a bad quarterly report.

We don't know if Snapchat will ever be able to right the ship -- but one thing's for sure.... they timed that IPO perfectly.