Market primed for a breakout? The S&P 500 (SPY) has […]

How does Retail Trading Sentiment Impact the Markets? ($SPY, $QQQ, $DIA, $IWM)

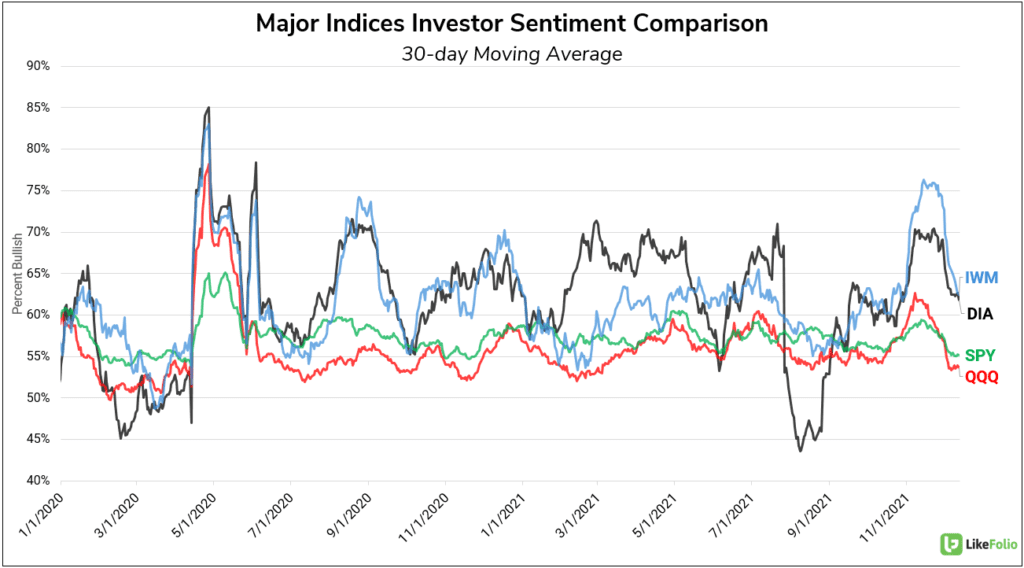

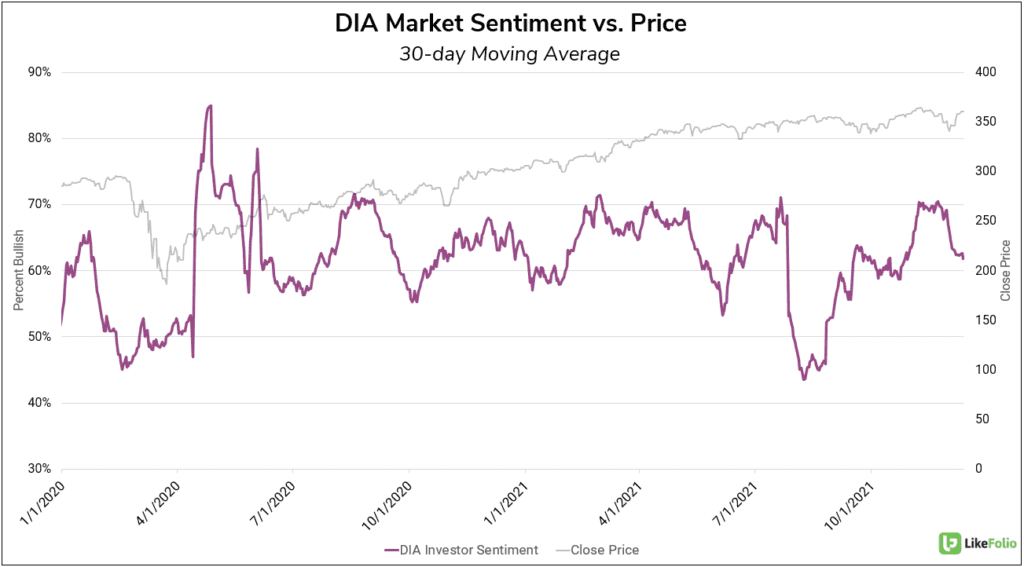

The role of retailer traders in the stock market has expanded significantly over the past 2 years…This trend has served to increase the power of LikeFolio’s social data as it applies to trading. Although small-time traders have negligible sway over the direction of the market, investor sentiment is an incredibly powerful tool. To illustrate this, we're diving into investor’s sentiment towards the 4 major market indices and their corresponding ETFs: NASDAQ ($QQQ), S&P ($SPY), Russel 2000 ($IWM), and Dow Jones Industrial Average ($DIA). Comparing the 30-day trend in sentiment mentions for all 4 indices (measured by percentage bullish) reveals a high degree of variance in individual investor’s view of each.

At a glance we can see that SPY and QQQ Sentiment has maintained relatively stability over time — Less excitement but also less despair. IWM sentiment showcases a higher degree of speculation and underlying price volatility. DIA's relatively low level of sentiment mention volume results in higher highs and lower lows.

Comparing Sentiment for each index against the underlying price performance allows us to expand our analysis.

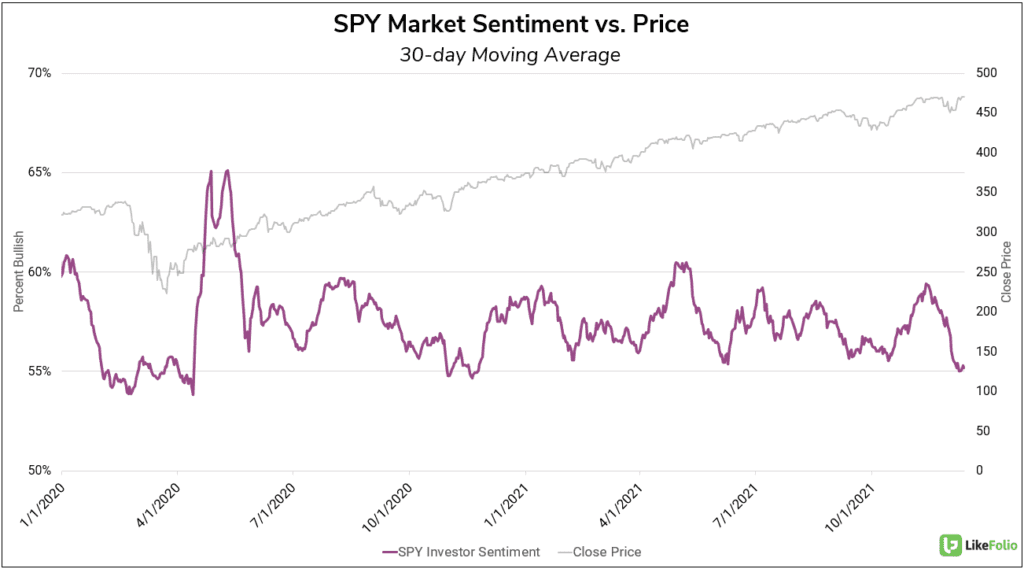

Over the past year, Investor sentiment mentions for the primary S&P ETF, $SPY, have held an incredibly tight range, between 55% and 60% bullish on a 30-day moving average.

Sentiment fluctuates cyclically, typically bottoming out near 55%. The bottoming action seen in the past week represents a bullish indicator with regard to recent price action.

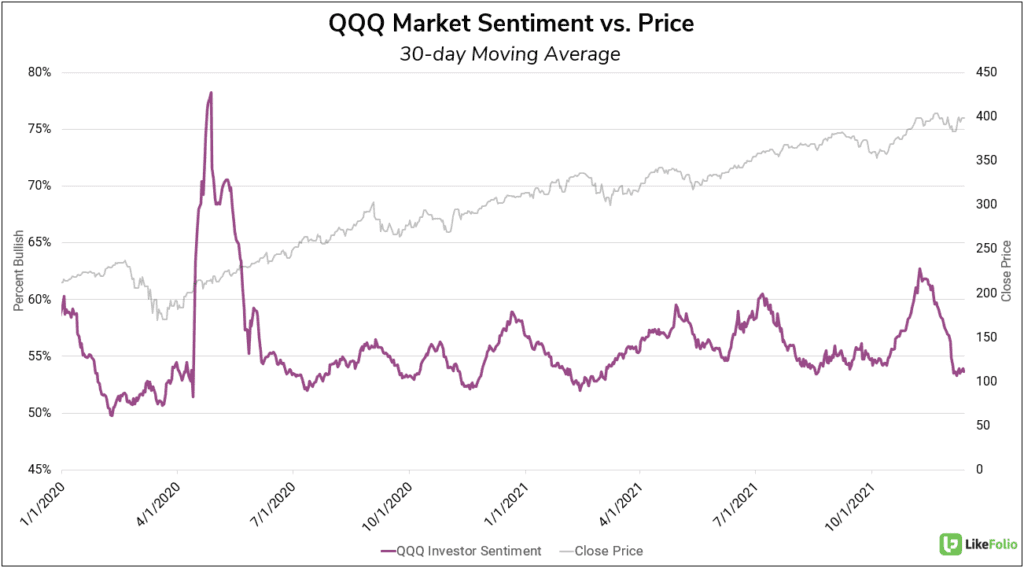

QQQ Sentiment follows a similar pattern but with a slightly wider range, between 50% and 60% bullish on a 30-day moving average.

Much like with SPY, sentiment bottoms below 55% positive have generally represented good long entry points.

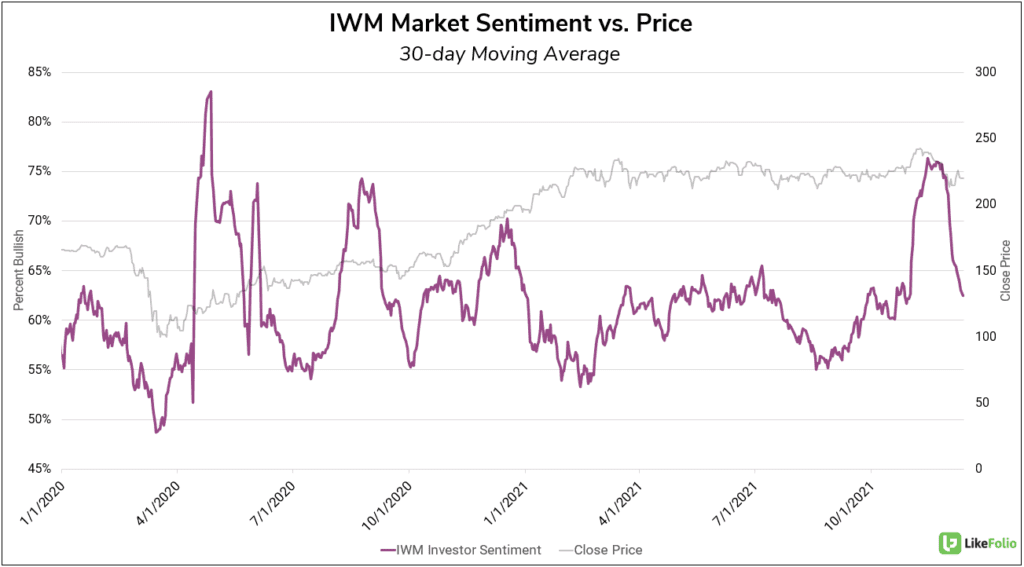

IWM Sentiment has fluctuated wildly by comparison and seems to suggest a slightly different trading strategy.

IWM sentiment has risen to near or above 75% bullish on numerous occasions, including last month. However, the Russel 2000 ETF typically hasn’t put on a significant gain until after sentiment levels have returned to normal....If history repeats itself, we can expect to see new highs for IWM in the first half of 2022.

Despite its relative price stability, DIA’s low volume of investor chatter makes sentiment more volatile than that of the other indices analyzed.

Like with the other indices, Sentiment low points have consistently served as strong buy signals for the market at large, particularly Crude Oil (CL=F).

Retail trading sentiment doesn’t give us one hard-and-fast trading strategy, but it does provide a valuable glimpse into the prevailing psychology of market participants — The takeaways aren’t ground-shaking revelations either, just common sense: Sell when market sentiment is high and turning lower and buy when sentiment is low and turning higher.