DG & FIVE: The Past and the Future of Discount […]

Five Below (FIVE) Consumer Buzz is Dropping

Five Below (FIVE) Consumer Buzz is Dropping

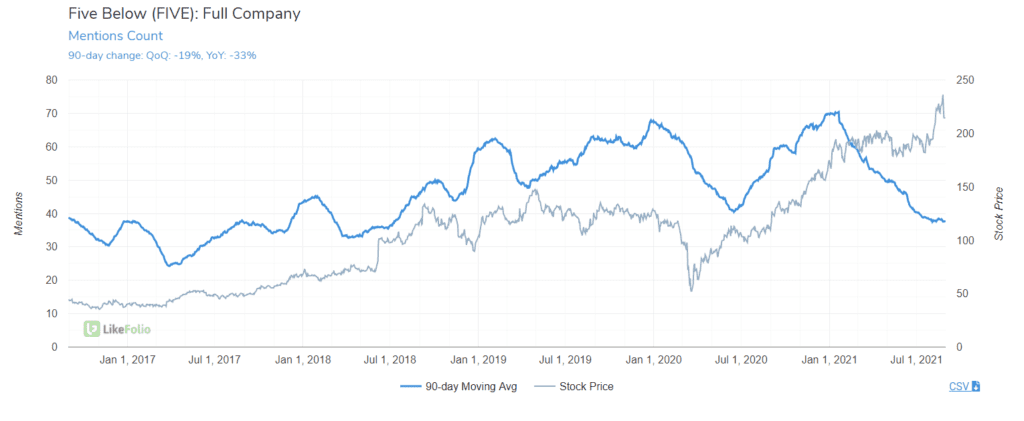

Five Below is facing tough comps as it prepares to lap the period when its stores reopened post-lockdown and stimulus-spending elevated.

The company has beat earnings expectations in the past four quarters and shares are trading accordingly: +68% YoY.

In the last week, FIVE shares have traded to the downside in reaction to Dollar Tree's lackluster earnings featuring: "continuing and well-publicized challenges in the global supply chain, as well as higher freight costs and other inflationary pressures."

Five Below is often lumped with Dollar Tree and Dollar General due to its discount retail status. However, Five Below is very different in the eyes of consumers:

- FIVE isn't focusing on groceries. Its bread and butter is "fun" stuff. Games, toys, electronics, collectibles, party supplies, etc.

- FIVE has pricing and potential margin power: higher quality products, higher price point. Instead of $1 (like Dollar Tree), Five Below now sells items up to $10, more in line with Dollar General's price variety.

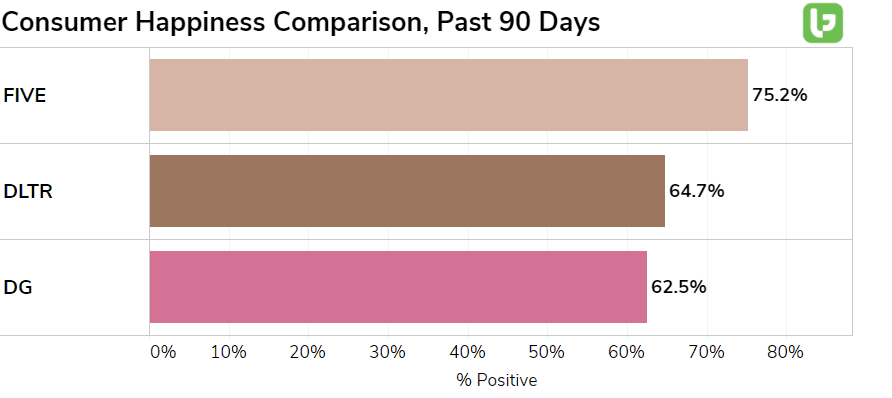

Five Below bests these traditional retailers in Consumer Happiness by 10 points: 75% positive (vs. DLTR at 65%, DG at 63%) because of its perceived store quality, discovery element, and product availability.

But this quarter, we are seeing signs of a slowdown that are a bit concerning.

Consumer mentions have dropped -33% YoY and continue lower QoQ. Purchase Intent is following a similar trajectory.

With the rate of store openings, we would expect to see some traction in Buzz as new consumers discover the store:

New stores have previously been the fuel for the Five Below growth engine, and the company is still expanding: "We expect to open 170 to 180 new stores [in 2021] with ~100 new stores opening in the first half of the year."

Landon talked about this today on the TD Ameritrade Network.