Travel Update: Airline Earnings It's time for the airline industry to report […]

$DAL and $LUV are Leading Airline Travel Recovery

June 14, 2021

$DAL and $LUV are Leading Airline Travel Recovery

Consumers are returning to the skies. Here are key Summer travel takeaways driven by LikeFolio data:

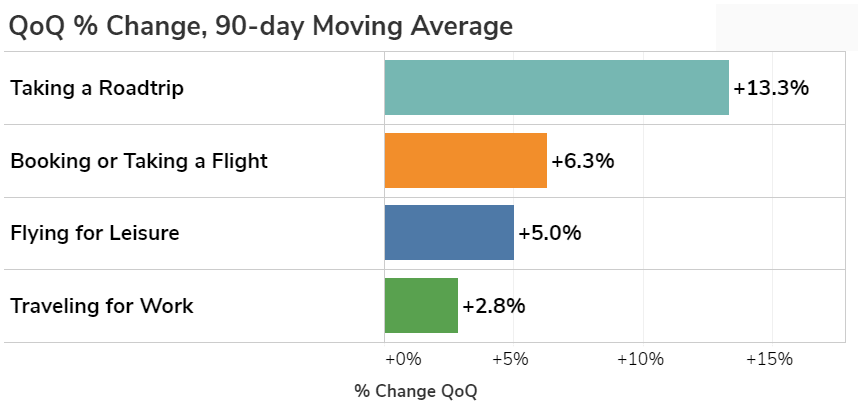

- Leisure Air Travel was the first to resume. Mentions of booking a flight for a vacation or personal trip began ticking up over the Holiday season and peaked around Memorial Day (seasonality here). Now pacing +5% QoQ.

- Work Air Travel is accelerating: +3% QoQ on a 90day Moving Average, but +9% QoQ on a 30day MA. These mentions are +34% higher YoY.

- There is some stickiness to road-tripping. While comprehensive "booking a flight" mentions remain -22% below 2019 levels, road-tripping mentions are 5% higher.

- International Travel Mentions remain low: not showing signs of improvement (actually lower YoY and QoQ).

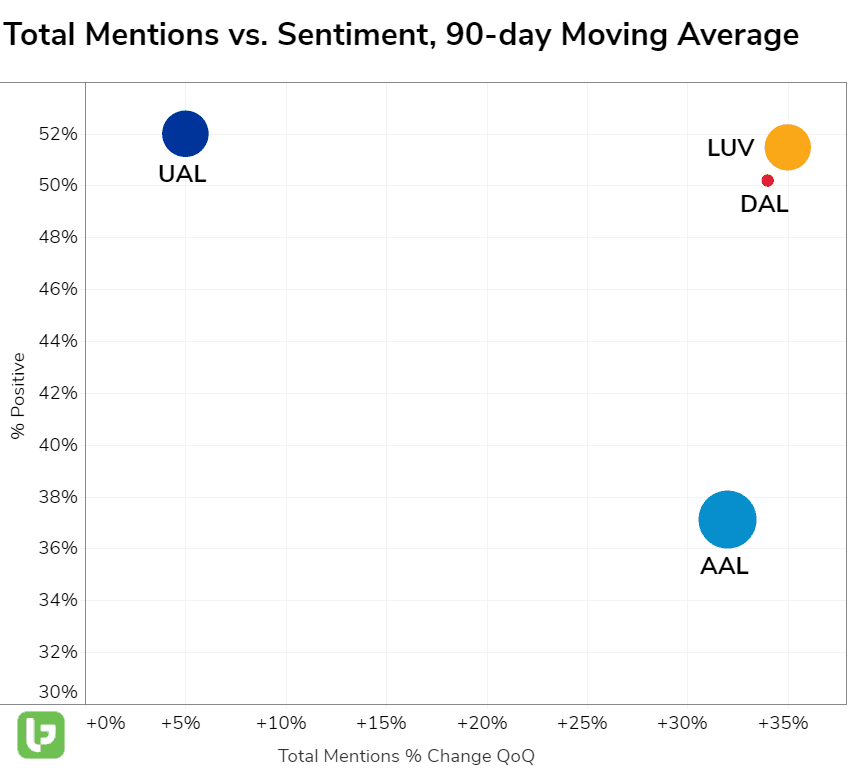

From an airline perspective, DAL and LUV are the clear leaders when it comes to recovery.

- LUV is maintaining a slight edge in regard to Consumer Happiness and QoQ Demand growth, but DAL is close behind.

- While AAL is recording growing consumer demand, its ability to make consumers happy is failing. Sentiment has dropped -10% QoQ due to poor customer service. Tweets like this and this and perhaps our personal favorite. Demand is likely falsely amplified due to the growing number of complaints from consumers.

- UAL has the slowest recovery, but Consumer Happiness is stable and in line with the industry average.

At the end of the day, it's clear air travel is resuming. But booking mentions remain well below pre-pandemic levels. $LUV and $DAL are improving their positioning with consumers. $AAL has serious work to do when it comes to Consumer Happiness.