Earnings Season Preview: Spoiler Alert We're getting excited. Earnings Season […]

CHGG is Dominating (CHGG)

CHGG is Dominating (CHGG)

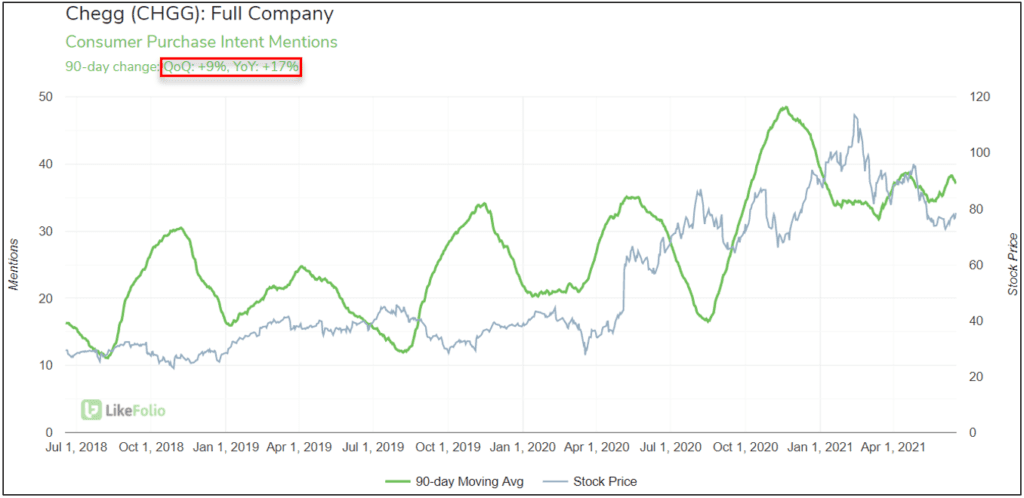

Mentions for the Spring 2021 semester show that Chegg (CHGG) is on pace for another phenomenal year.

Despite universities reopening for in-person classes across the U.S., consumer demand for Chegg's textbook rentals and other academic services are maintaining an impressively high level: +17% YoY and +9% QoQ on a 90-day moving average.

CHGG is coming off a record performance in 2020 and smashed revenue expectations for 21Q1 (ended 3/31). All signs point to continued outperformance... In addition to robust YoY Purchase Intent growth, Consumer Happiness has risen by a staggering +21% YoY vs. last year's lows: 73% positive (90-day moving average). We established a long-term bullish position last December – Although Shares ran +30% from our entry, they’ve since forfeited those gains, as non-reopening plays lost favor with the market. Based on the strong underlying data, we're happily doubling-down at the current price.