Spotify (SPOT) purchase intent surging Spotify Purchase Intent was the […]

Can Chewy (CHWY) Keep Clearing a High Bar?

Can Chewy (CHWY) Keep Clearing a High Bar?

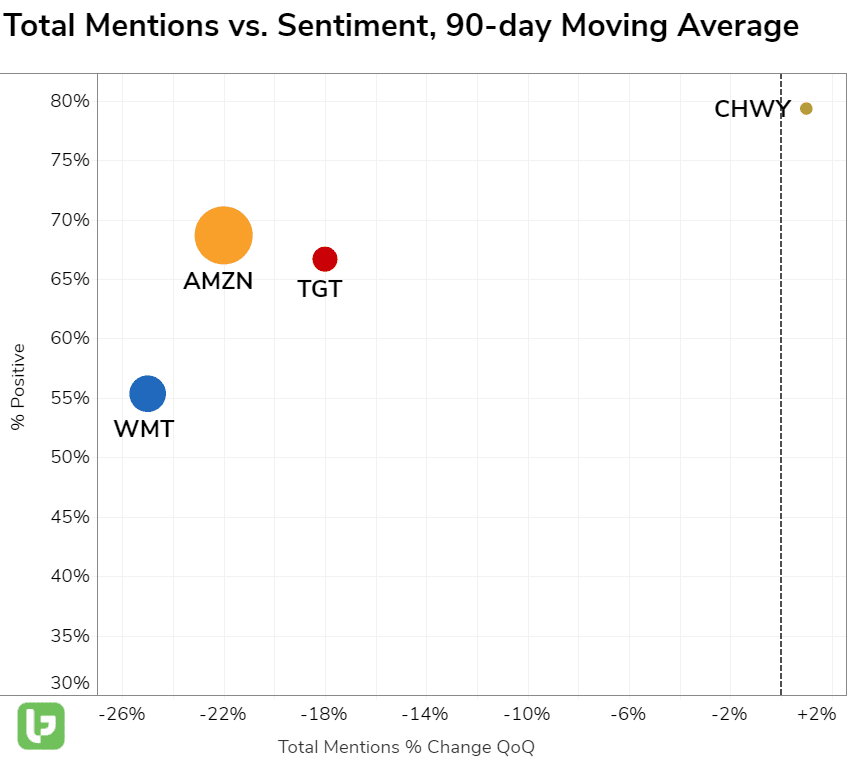

Last quarter, CHWY shares popped +8% post-earnings after delivering a report that beat expectations: Net sales increased more than 50% YoY, driven by active customer growth and increased purchasing behavior. Translation: Chewy is very good at engaging its customer base and encouraging repeat purchases. This loyalty is apparent in Chewy's Consumer Happiness levels: 80% positive and rising (+4% YoY), and far exceeding retail peers.

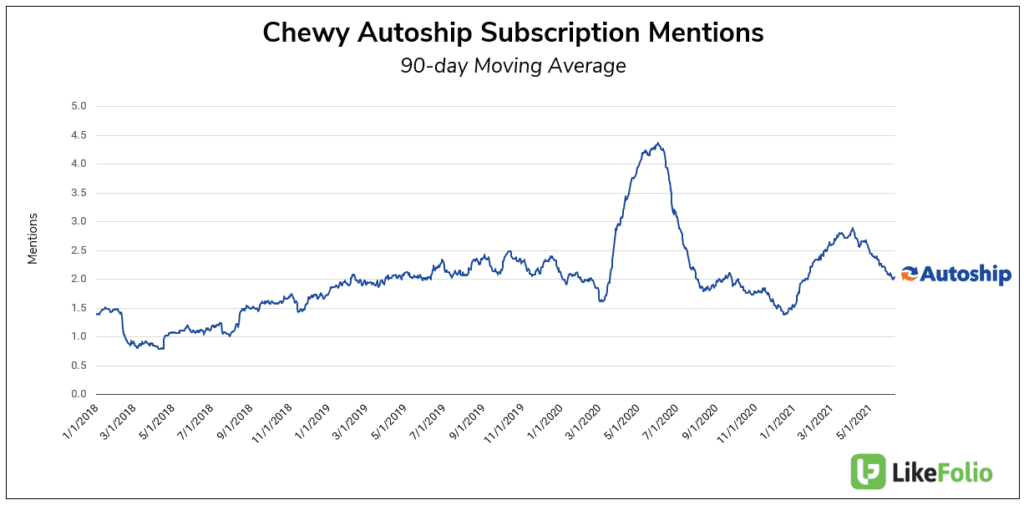

Another key driver of Chewy success is its Autoship feature: Autoship net sales represent more than 68% of total net sales. LikeFolio data shows that Autoship subscription mentions increased +16% in 21Q1 vs. 2019.

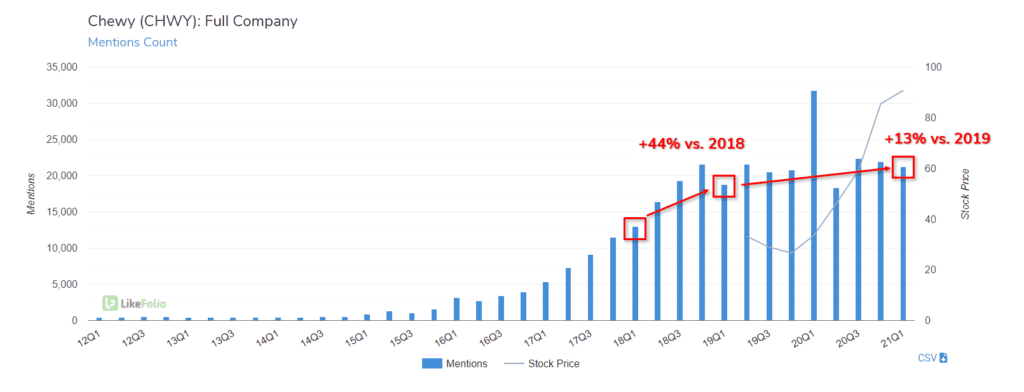

The Caveat? Total Mention growth is slowing down. While mentions are +13% higher vs. 2019, this represents a pretty steep slow down in growth compared to last year and 2019, when mentions grew by +44% YoY.

Chewy has elevated levels of short interest heading into earnings (24%), so if you do play this to the downside, stay risk defined. Long-term, it's clear Chewy is the gold standard when it comes to Pet supplies.