Stock Chatter Shows When AMC isn’t Safe to Short The […]

$AMC...More than a Meme Stock?

$AMC...More than a Meme Stock?

AMC is the largest movie theater chain in the world: 950 theaters, 10,500 screens globally.

Movie Theater demand was decimated in Covid. AMC was within months/weeks of running out of cash 5 different times between April 2020 and January 2021.

In FY 2020, AMC Revenue dropped -77% YoY, U.S. attendance fell -81% YoY.

In January 2021, AMC emerged as a quintessential meme stock when reddit retail traders pivoted from a successful GameStop push to AMC.

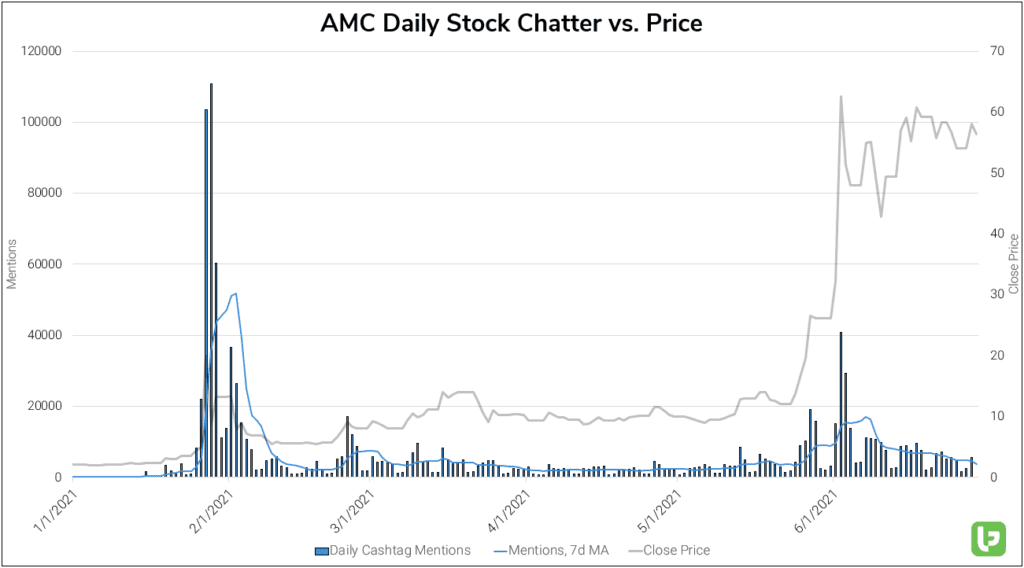

You can see this surge in activity on the chart below, displaying stock chatter mentions.

While shares surged, the company secured a European financing deal (+$400 million) on top of other equity and debt capital, avoiding bankruptcy

One main difference between Reddit-fueled AMC and message-board-fueled Penny stocks in the past? AMC has a legitimate business. And many in the Reddit army aren't dumping.

Instead of feeding the pump frenzy with press releases, AMC issued millions of shares into the market in an attempt to stay solvent.

At the end of 2019, AMC had 103.9 million shares outstanding. Last month it had nearly 502 million.

But how is AMC performing from a consumer perspective?

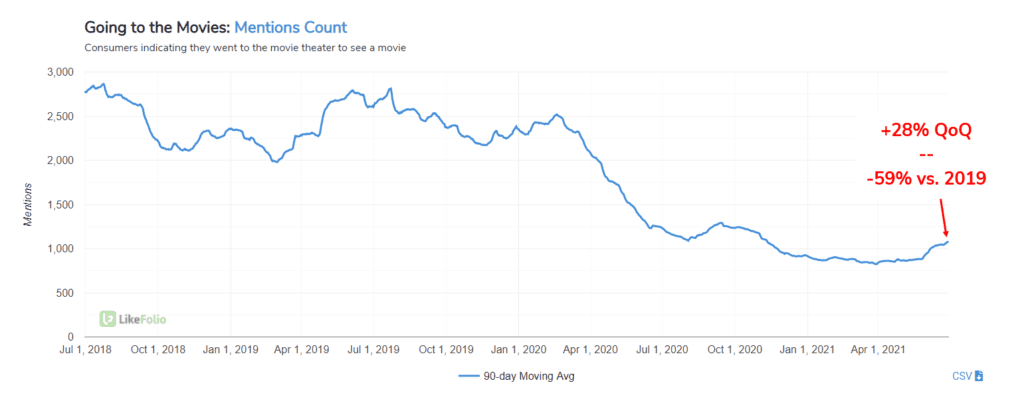

LikeFolio data shows the company has a large hill to climb.

Mentions of Going to the Movies have increased +28% QoQ, but remain -59% lower vs. 2019.

AMC is likely the best positioned to take advantage of reopening.

The company noted market-share capture on its last earnings call: +25% vs. pre-pandemic levels, with a total share of 33%.

However, consumers are increasingly receptive to streaming theatrical releases.

Mentions of streaming a new release surged in the last year, sparked by Disney's release of Mulan (for $30), and Warner Bro's plans to release new features on HBO Max and in theaters simultaneously.

Streaming new theatrical release mentions are now settling +92% higher vs. 2019.

The company is confident it can capitalize on pent-up consumer demand as localities reopen.

We'll be watching this trend and consumer-facing data to confirm if demand materializes.

Due to the meme-nature of the beast, we're not just listening to consumer-facing chatter about AMC. We're also listening for what traders have to say.

We separate and feature this type of data in our Stock Chatter alerts. In fact, we've issued stock chatter alerts for AMC when shares were at $13.18 and $27.14.