Drinker’s tastes and priorities are shifting in a major way. […]

AAPL Earnings Preview

AAPL reports earnings tonight after the bell, and that has all eyes on LikeFolio Earnings Prediction data.

That's because our bearish call on AAPL at $225 immediately after the 2018 keynote has convinced so many investors and researchers that our consumer purchase intent data is highly predictive of company revenues.

So what's the data suggesting for this earnings report?

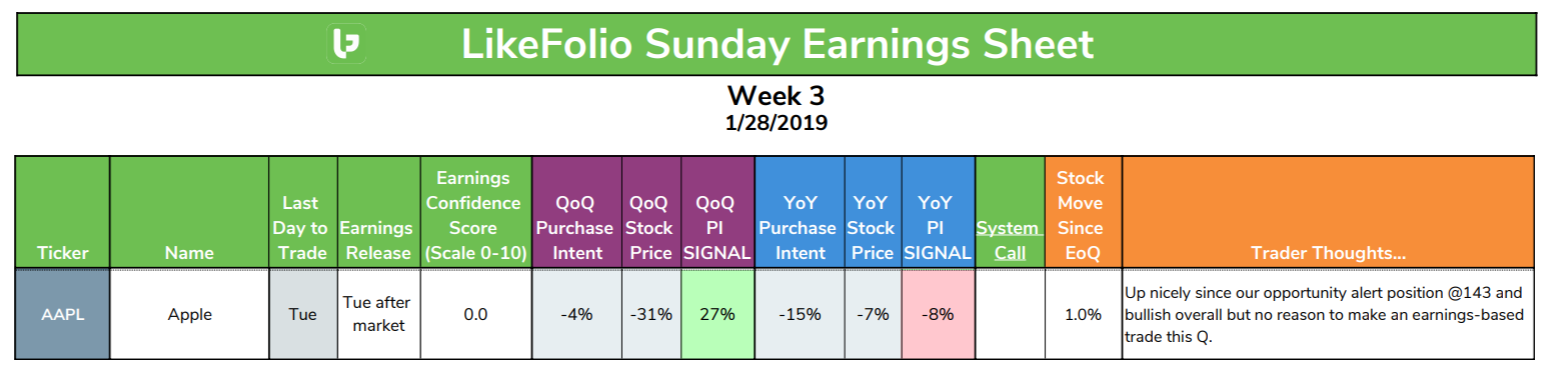

The screenshot above was taken from this week's Sunday Earnings Sheet.

Here are the key takeaways:

- Our amazing history of predicting AAPL stock movements in the quarters following their keynote events does NOT translate to success with predicting individual earnings events. On AAPL, we're just better longer term. A confidence score of 0/10 is obviously as low as it gets for LikeFolio data. For comparison, this week's sheet alone has 16 plays with a confidence score of 7.5 or greater.

- "PI SIGNAL" is one of our proprietary scoring methods that leads to our impressive earnings trading history as detailed in the LikeFolio Trading Signals White Paper. For AAPL this quarter, we have a mixed bag, with the Quarter over Quarter PI signal bullish, while the Year over Year PI signal is bearish. This leaves us with no "System Call."

After the massive decline in AAPL stock following our Bearish Alert in September, LikeFolio actually issued a Bullish Opportunity Alert for the stock at $143/share.

As you can see in the report, this was issued as a longer-term play based on the oversold condition of the stock when compared to our purchase intent mentions. In other words, we could see that while Apple had certainly disappointed consumers with its new iPhone lineup, Wall St. had likely overreacted.

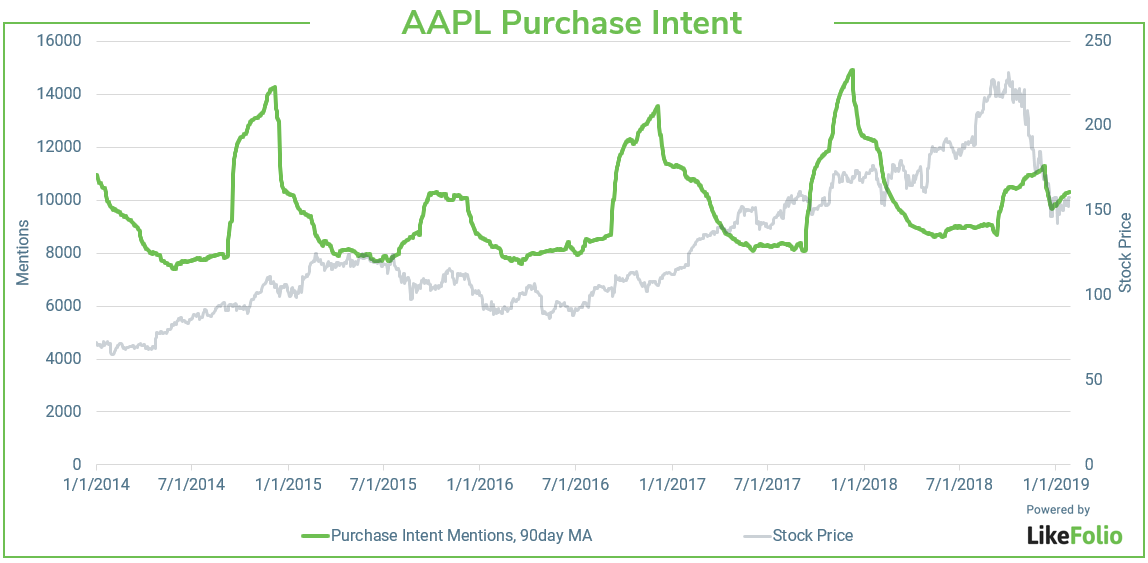

Here is a current look at Apple Purchase Intent Mentions for analysis:

As you can see, this past quarter's PI mentions were very similar to the 20156/2016 disappointment (which was followed by a sluggish performance for the stock). But it is not disaster. The lows are higher and we are even starting to see some signs of uptick during a time of year where things normally die down for the company.

In other words, Apple is far from dead. We'll leave our bullish position on until the consumer purchase intent data suggests otherwise, or (more likely), the stock recovers to levels that eliminate the advantage of our data.

And then it'll be a waiting game for the next Apple Keynote opportunity to come along... they always do!

— Get a Season Pass today and join the LikeFolio Earnings Season. We'll send you this week's Earnings Sheet immediately along with our full video analysis of the opportunities.... and every week for the next 3 months!